Operating in today’s healthcare delivery environment requires managing an intricate network of patients, clinicians, medical support staff, administrators, medical devices, budgets, and other various factors that affect care delivery and outcomes. Even before the global pandemic, and especially afterward, healthcare systems have been facing changing market dynamics that impact care delivery. Such dynamics include financial pressures, consolidation, growing consumerism, and talent retention. As mergers or partnerships cause these healthcare enterprises to grow in geographical extent and complexity, these challenges only increase.[1]

Large and local hospital systems have faced rapid horizontal consolidation.[2] COVID-19 helped to influence decreases in healthcare spending—resulting in significant revenue declines—potentially accelerating the consolidation rate among healthcare providers.[3] In France, Germany, and the United States, for example, over 60 percent of hospitals are now part of a wider privatized healthcare network to help concentrate services, improve patient care, and leverage greater negotiating power. Additionally, the United Kingdom has seen significant success with the operational merger of several National Health System trusts.[4]

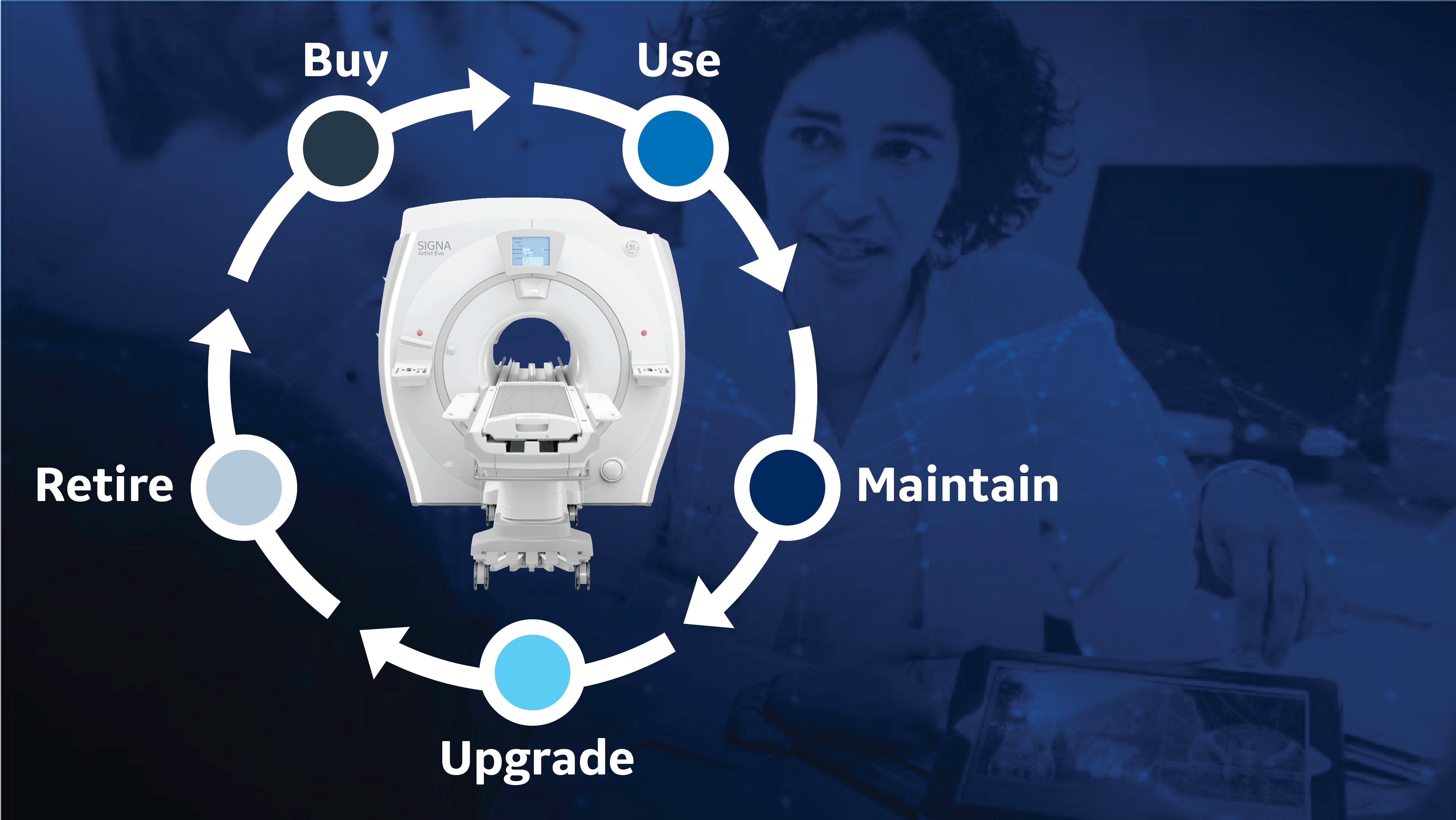

Healthcare administrators understand the changing current environment and work to ensure their health systems have long-term clinical asset management plans in place. For example, exploring upgrade options in radiology as a key strategic component across the product lifecycle of their imaging fleet represents an innovative opportunity to access the latest clinical imaging capabilities, while prolonging the utility of existing systems.

Preparing health systems for the long term

As health systems expand through increasing consolidations, department administrators are challenged with monitoring and ensuring uniform care delivery across all locations. This is especially important in radiology, where maintaining consistency and quality is vital throughout any consolidation process. More than 80 percent of all hospital and health system visits include at least one imaging exam per patient.[5] Radiology staff and medical imaging play a critical role in these patients’ care journeys, performing more than four billion procedures annually.[6]

As demand for imaging services continues to rise, health systems face decisions around medical imaging technology investment planning and maintaining their existing operational imaging systems. In an IMV report on Global Imaging Department Priorities and Outlook, radiologists reported two of their top three priorities as equipping their department with state-of-the-art medical technology and improving department workflow efficiency and productivity.6 Often, outside industry experts are consulted for assistance in building efficiency and sustainability for a health system’s long-term planning.

Managing a health system fleet effectively

Clinical asset management for an entire fleet of patient care technology can be a daunting task for healthcare providers. Without increased visibility, it is challenging to optimize performance or understand the utilization of each asset. It’s critical to know how each medical imaging system is being used and how it is performing. Other important considerations include understanding each device’s level of cybersecurity and its maintenance requirements, for both predictive and unplanned downtime events.

One effective strategy to address these needs is to work with a partner who understands the hospital’s current position and future goals. Often, that partner can analyze gaps to strategically inform plans for any future medical technology investment planning. The analysis can also help to reveal asset utilization and performance data for complete asset visibility. Additionally, it is possible to optimize current asset performance and understand the health of each clinical asset from a maintenance and security perspective.

With potentially thousands of devices under management, large healthcare providers can lean on a trusted services partner to to help them achieve clinical improvements and significant cost savings by planning their technology needs around their clinical and operational workflow.

- Using upgrades as a planning strategy, providers can improve their access to current technology hardware and software tools, including artificial intelligence (AI) applications that can help boost efficiencies, improve image quality, and impact diagnostic accuracy and clinical outcomes.

- Remote monitoring and data analysis can also offer actionable insights to help optimize operations, reduce equipment downtime with predictive maintenance, and result in fewer service interruptions for equipment.

- Standardizing technology and operations to help improve efficiencies and maintain quality care.

Working with an industry partner can also simplify the procurement process and create more consistent equipment training.

Partnering to improve product lifecycle management

The right industry partner can support comprehensive technology asset management to help facilities acquire and maintain their medical equipment, which is vital for high-quality, effective, and reliable patient care. Product lifecycle management partners often support services, such as upgrading existing equipment, procurement, financing, maintenance, clinical asset management, commissioning and decommissioning of equipment, and staff training.

Centralizing the management of these functions and achieving economies of scale are some of the benefits of working with an industry partner to manage technology assets. These partnerships can help to improve predictability and stabilization of a facility’s capital, operational, and cash flow structures with appropriate planning.

As a leader in the healthcare industry, GE HealthCare partners with hospitals and integrated delivery networks to provide planning, management, and service for medical technology assets.

“We’re working with our customers as a partner to not only manage technology assets from initial installation through end-of-life,” said Donna Dyer, Executive of Business Operations at GE HealthCare, “but also to effectively structure long-term planning to support their goals to sustain an ongoing path of high-quality care.”

Working with the right partner, hospitals and health systems can have a better understanding of their equipment utilization today, balanced with their future capacity projections, workforce constraints, or growth plans, leading to more sustainable technology investments. For example, they could plan to upgrade systems rather than purchase new to expand clinical capabilities. Several existing and new imaging systems in computed tomography (CT) and magnetic resonance imaging (MRI) are built for scalability that enables upgrade planning for both hardware and software.

Optimizing medical imaging technology for a sustainable future

Some radiology departments are keeping their medical imaging equipment operational longer.[7] Pre-COVID-19 market data suggested that 60 percent of facilities were planning to purchase a CT or MRI system.6 But new data suggests they are extending the lifecycle of advanced systems such as MRI and positron emission tomography (PET) by two or three years, respectively, and these facilities may have to revisit their medical technology investment plans soon to consistently deliver the highest quality imaging services to their patients.7

While advanced imaging technology and efficient solutions can help improve clinical decisions and support radiology department operations, investing in new equipment may not be an option. Providers are looking for innovative approaches to optimize their existing technology assets for today’s patient care and sustainability.

Managing existing medical imaging technology throughout the product lifecycle, including upgradeability and serviceability are effective ways of extending the life of an imaging asset, while accessing advanced capabilities enabled by new technologies and AI applications.

In addition to the performance benefits of a software or hardware upgrade, taking advantage of upgrade options for existing imaging technology can allow for significant cost savings, when compared to investing in new systems. Planning and construction associated with installing new systems can be costly and can disrupt care delivery due to downtime needed for installation. Alternatively, upgrading the hardware or software of existing technology can require less investment and downtime, which could result in reduced disruption to patient care. At the same time, upgrades have the potential to enable providers to achieve similar levels of clinical performance, operational improvements, and financial outcomes as new technology investments, while contributing to environmental sustainability by extending the usable life of the system.

Strategic planning for future growth

When a health system plans for an efficient and sustainable future, working collaboratively with an industry partner on clinical product lifecycle management can lead to quality care delivery, operational productivity, and an improved financial outlook.* With its broad expertise in medical diagnostics, imaging and information technology, GE HealthCare is committed to partnerships in technology management to meet the future goals of its customers in delivering high-quality patient care.

RELATED CONTENT

- View the on-demand presentation: Capturing maximum value throughout the technology lifecycle

- Learn more about GE HealthCare’s services and lifecycle management.

DISCLAIMERS

Not all products or features are available in all geographies. Check with your local GE HealthCare representative for availability in your country.

*GE HealthCare does not warrant or guarantee profitability. Ability to achieve profitability is dependent on factors specific to each customer.

REFERENCES

[1] Venkataraman V, Browning T, Pedrosa I, Abbara S, et al. Implementing shared, standardized imaging protocols to improve cross-enterprise workflow and quality. J Digit Imaging. 2019 Oct;32(5):880-887. doi: 10.1007/s10278-019-00185-4.

[2] The National Institute for Health Care Management. Hospital consolidation: Trends, impacts, and outlook. Nihcm.org. https://nihcm.org/publications/hospital-consolidation-trends-impacts-outlook. Accessed January 13, 2023.

[3] Schwartz K, Lopez E, Rae M, et al. What we know about provider consolidation. Kff.org. https://www.kff.org/health-costs/issue-brief/what-we-know-about-provider-consolidation/.

[4] Nolte E, Pitchforth E, Miani C, et al. The changing hospital landscape. RAND Health Quarterly. 2014;4(3):1. https://www.rand.org/pubs/periodicals/health-quarterly/issues/v4/n3/01.html

[5] Smith-Bindman R, Miglioretti DL, Johnson E, et al. Use of diagnostic imaging studies and associated radiation exposure for patients enrolled in large integrated health care systems, 1996-2010. JAMA. 2012;307(22):2400-2409. doi: 10.1001/jama.2012.5960.

[6] IMV Medical Information Division. 2019 Global Imaging Outlook Report. IMVinfo.com. https://imvinfo.com/product/imv-2019-global-imaging-market-outlook-report/

[7] Feder J. Radiology Oncology Systems. Medical equipment continues to age in the United States. https://www.oncologysystems.com/blog/medical-equipment-continues-to-age-in-the-united-states. Accessed January 13, 2024.